Discussions on the carbon emissions produced by the United States inevitably get redirected towards China. While China as a country emits over double the total CO2 emissions than the US, there is a lot more to the discussion.

The US is the second largest emitting nation of CO2 behind China. The per Capita emissions of China are less than half that of the US and the US emissions are 7 times more than the sustainable limit. Neither comparison between the 2 countries gives the whole picture, but one simple fact is clear – both countries must reduce their emissions to below a sustainable limit to mitigate the effects of Global Warming.

So, what are both countries doing?

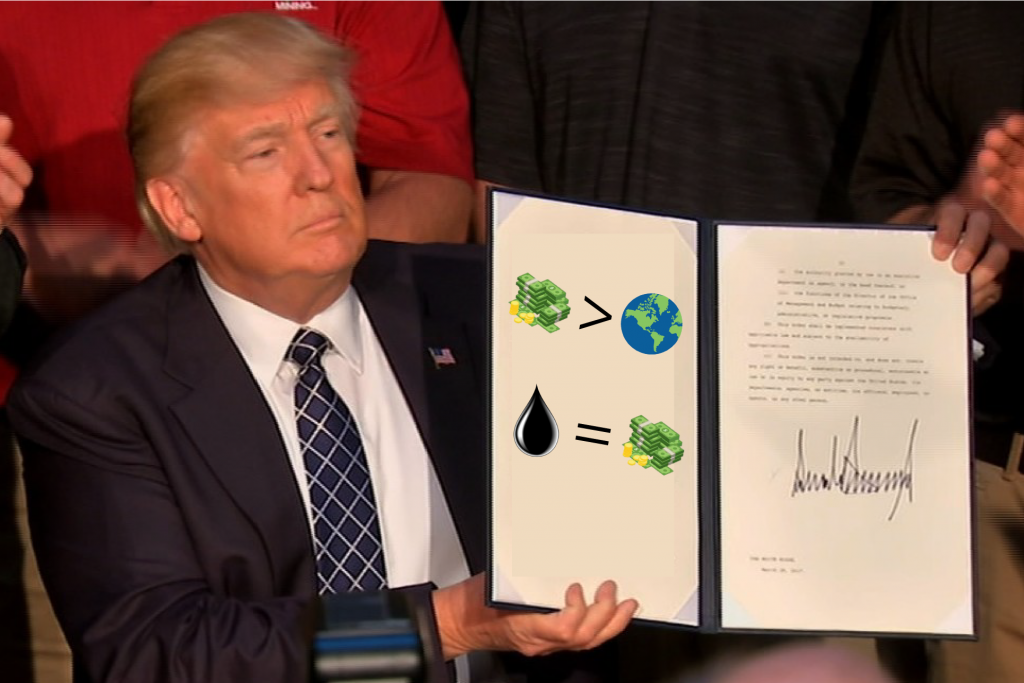

The current US administration gave a formal notice of intention to withdraw from the Paris Climate Agreement (November 4, 2019); removed barriers from the Keystone XL and Dakota Access Pipelines so the companies sponsoring them can continue with production (January 24, 2017); signed an executive order to boost the coal industry (March 29, 2017) and rolled back 6 executive orders from the previous administration aimed at reducing climate change and carbon emissions.

Meanwhile, in 2017, China invested $126 Billion in renewable energy – 3 times the investment of the US. And going forward, China will invest $361 billion in clean energy by 2020 to generate 13 million jobs – which could make China the largest Green Economy in the World. China is already the largest market for electric vehicles, with plans to build manufacturing to increase the number of EV’s by over 5 million before 2020.

If Climate Change is a hoax, this shouldn’t matter for the US economy right?

In 2018, over 20% of US exported fossil fuels were sent to China. Removing this from the bottom line is a $10 billion loss for the US – a drop in the ocean for a $20 trillion economy. But if the US cannot find a buyer for these exports, jobs will be lost. Currently the green economy employs 10 jobs to every 1 in the fossil fuel industry. So it makes sense to start the sustainable transition now.

China is transitioning to position itself as the leader of green economies, renewable infrastructure, and renewable technology. With the rest of the world also changing policies to align with a sustainable economy, they will inevitably look to China for support.

And China is not just relying on government initiatives to drive the green transition. Companies such as Alibaba, the “Amazon of China”, are currently taking steps to improve their sustainability. Since 2014, Alibaba has moved its data centers to the Guizhou province where they are powered by renewable hydroelectric power and the mountainous terrain provides natural cooling.

Additionally, after 11.11 (commonly referred to as “singles day”, the largest online shopping day on the Chinese calendar), Alibaba initiated a “National Cardboard Recycling Day” on November 20, using 75,000 recycling stations to facilitate the returns and marking them on Alibaba’s navigation app, Amap (the market leader in China with 340 million monthly active users).

Amazon also has sustainable ambitions. CEO Jeff Bezos has said that Amazon would aim to reach 80 percent renewable energy by 2024 and 100 percent renewable energy by 2030 on its path to net zero carbon by 2040. So far these have only been words. For a company that had a profit of $11.2B in 2018, their lack of concrete action shows us that they don’t care at all about our planet. These large corporations need to lead the way to a sustainable economy.

Trying to predict the future has squandered the careers of many smarter than us. But not recognizing the potential for future change seems like burying our heads in the sand. The current US administration need to study the downfall of Blockbuster. Otherwise China may just be the next Netflix because, “Those who do not learn history are doomed to repeat it.”

We should stop betting our nation’s economy on a future powered by the fossil fuel industry. It will not only destroy our planet but may also crumble its economic well-being as well.